Bpifrance, Siparex, Desjardins Capital and Export Development Canada launch the Transatlantic Fund, designed to finance the development of businesses on the European and North American continents. 75 million (C$120 million) fund.

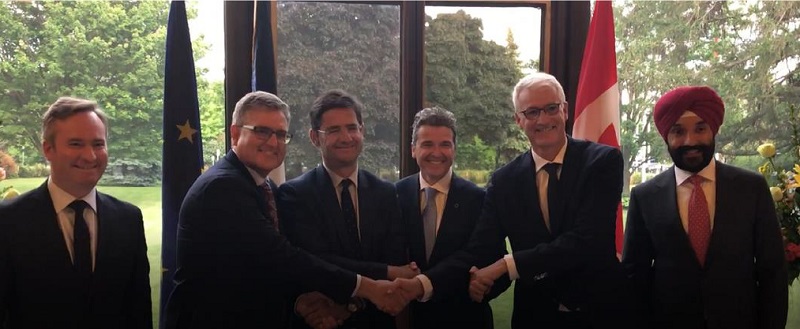

Dn the extension of the partnership formalized last September, Bertrand Rambaud, Chairman of the Siparex Group, said (1), Luc Ménard, Chief Operating Officer of Desjardins Capital (2), Nicolas Dufourcq, Managing Director of Bpifrance and Benoit Daignault, President of Export Development Canada (3), launched the Transatlantic Fund in Ottawa today.

This announcement, made at the Embassy of France in Canada, on the occasion of the visit to Canada of Emmanuel Macron, and in the presence of Jean-Baptiste Lemoyne, Secretary of State to the Minister of Europe and Foreign Affairs of the French Republic, Mr. Navdeep Bains, Canada's Minister of Innovation, Science and Economic Development, Ms. Kareen Rispal, Ambassador of France to Canada, and Ms. Isabelle Hudon, Ambassador of Canada to France, marks the closing of the Transatlantic Fund at 75 million euros ($120 million Canadian).

75 million fund, jointly managed by Siparex and Desjardins Capital, makes it possible to co-invest in French and Québec SMEs to support their growth. This co-investment strategy is supported by a dedicated bicultural team of experienced professionals based in the partner country. Thus, a dedicated Siparex resource is already located in Quebec while a Desjardins Capital resource will be based in France. This approach allows the partners to support the development of French companies in the North American market from Quebec and, conversely, that of Quebec companies to the European market from France, which represents a market estimated at more than half a billion consumers.

Accompanied SMEs will have access to international growth and benefit from ecosystems on both sides of the Atlantic. Entrepreneurs will have access to the business networks developed over the past 40 years by Siparex and Desjardins Capital in their respective markets and their means, through active collaboration.

The creation of this fund comes in a particularly favourable economic context thanks to the provisional application of the Free Trade Agreement between the European Union and Canada (FTAA) since 21 September 2017, following seven years of negotiations.

For Nicolas Dufourcq, Managing Director of Bpifrance : "Bpifrance has made the development of French companies abroad a strategic priority. By sponsoring the Fonds Transatlantique, we are reaffirming our determination to encourage and support the growth of French companies in the huge market that is the North American continent. This bilateral fund, led by two recognized players and benefiting from the strength of their respective networks on each of the two continents, will enable SMEs and ETIs to access new opportunities. »

According to Bertrand Rambaud, President of Siparex, manager of the Transatlantic Fund in Europe : "Supporting the international development of companies has been at the heart of our Group's concerns for many years. In a philosophy of co-development regularly When put into practice, the Transatlantique fund complements the support offered to portfolio companies with strong development potential in North American markets. We are proud to launch this fund with Desjardins Capital, Bpifrance, CRCD and EDC. ».

"Desjardins is proud to support the internationalization of Québec SMEs, said Guy Cormier, President and Chief Executive Officer of Desjardins Group. "Our new fund was created to support the development and growth of our businesses in Europe in a market estimated at more than half a billion consumers. In addition, we are establishing a first with EDC, as this is the first partnership between Desjardins Group and a federal Crown corporation. »

"The Transatlantic Fund is an innovative way to help more Canadian companies take advantage of the Canada-European Union Comprehensive Economic and Trade Agreement (CETA), which will increase the growth of Canadian companies into the world's second largest economy, while encouraging the diversification of our international trade, says Benoit Daignault, President and CEO of EDC. "Export Development Canada is proud to invest alongside French and Canadian partners to strengthen commercial ties between the two continents.

(1)The Siparex Group, created 40 years ago, is the independent French specialist in private equity in SMEs and ETIs. The Group has €1.8 billion of capital under management, divided between Midmarket (SME/ETI), Mezzanine, Small Caps (SME) and Innovation activities under the XAnge brand (Startups in the Digital, Deep Tech and Impact sectors). Siparex covers the entire national territory from Paris, Lyon, Nantes, Lille, Strasbourg, Besançon, Dijon and Toulouse. Also internationally oriented, the Group is established in Europe in Madrid, Milan and Munich and has partnerships in Canada and North Africa (Tunisia, Morocco and Egypt).

Siparex and Desjardins Group have had a relationship for more than 30 years, with the Canadian group being a loyal subscriber to Siparex funds since the early 1990s, and several of its representatives having held directorships on the Board of Directors of the holding company of Siparex Group.

(2) With nearly 45 years of expertise, Desjardins Capital (formerly "Desjardins Venture Capital") has a mission to develop, support and retain companies and cooperatives in Québec. With assets of more than CDN$2.1 billion, Desjardins Capital and its ecosystem contribute to the sustainability of more than 450 companies, cooperatives and funds operating in various sectors of activity and from all regions of Québec. In addition to helping maintain and create more than 67,000 jobs, this component of Desjardins Group offers entrepreneurs access to a broad business network. It is also a complementary source of capital to support the growth of their businesses. Desjardins Capital manages Capital régional et coopératif Desjardins (CRCD), a public company with more than 105,000 shareholders.

(3) About Export Development Canada (EDC): Canada's export credit agency, EDC provides financial services to companies buying from Canadian companies, or to companies whose value chains include Canadian supply and services. EDC's financing, which can respond to requests for capital expenditures or project financing, is provided through bilateral or syndicated facilities.