The exit of the United States from the Paris Agreement, announced in June, sent a first negative signal. Since then, numerous reports have pointed to a worrying gap between the objectives collectively agreed in Paris and the actions actually taken. Rich countries are financially cautious, while developing countries are lagging far behind in developing climate policies that will enable them to meet their commitments. A gap that the UN considers "catastrophic" between actions and needs. As always, it is financing that is the problem. As it stands, the Paris Agreement seems compromised. Should we then change paradigm and think about a plan B?

Taxing carbon removals and externalities rather than emissions: this is an inherently more incentivising and operational alternative to overcome bottlenecks and limits to the energy transition. It is the result of an analysis (1 and 2) by Jacques de Gerlache, (eco)toxicologist, active member of the Club of Rome, manager of GreenFacts (3) and Romain Ferrari, Chairman of the 2019 Foundation (4), think tank on the links between ecology and economy. Demonstration and explanations.

L’The Paris Agreement signed by the majority of States and COP 21 and 22 will have enabled an unprecedented raising of public awareness. But despite the efforts of some and the diplomatic appearances that have been made, this Agreement is now coming up against multiple economic, political and political realities. The isolated stance taken by the President of the United States is the most tangible sign of this. A multitude of national, regional and local initiatives that were beginning to emerge from the Agreement and its follow-up (COP 22) risk being infinitely complicated.

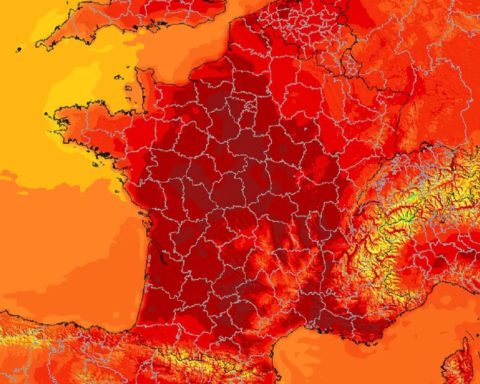

Even if a minority (in number but not in impact!) still (re)questions the materiality of this warming, or even the role that human activities would play in it, considering that they represented only a tiny part of it, would it not be better to avoid "the drop that breaks the camel's back"? Because even without reaching 2°C of global warming, the risks of climatic events are not only linear, but those of abrupt and generalized transitions, comparable to the triggering of avalanches or earthquakes. These risks are in fact becoming higher, particularly with the already irreversible climatic upheavals experienced by the Arctic region, which could soon cause sudden and irreversible upheaval in the global climate balance as a whole.

With regard to the means to be mobilised, Mr Mezouar, President of COP22, himself stated that not only should the commitment of 100 billion dollars by 2020 be met, but, faced with the scale of what is needed to deal with the impacts of climate change, thousands of billions will be needed, as confirmed in particular by the Word Energy Outlook 2016. (5). This is in a context of downward pressure on oil prices, with the objective of making U.S. shale gas uncompetitive and to the point of constituting a real risk of a "crisis of subprimes related to the loans granted by banks to thousands of their operators (6). In addition, the hundreds of billions of dollars in subsidies still given to fossil fuels, particularly in developing countries, keep their prices artificially low. (7) and the price associated with carbon emissions remains much lower than these subsidies and constitutes an overall negative balance sheet. (8).

Taken in isolation, each player has an interest in delaying its contribution to the collective effort until all the others reduce their emissions. And it is to put an end to this "waiting game" so named by Gollier and Tirole (9), that the price of carbon, according to Christian de Perthuis, should reflect the value that the community actually places on climate protection. This is all the more important as there is still a lot of fossil energy available that would have to be essentially foregone (60%) in the absence of efficient CO2 capture technologies.

It is in this context that the COP21 agreement put an end to the principle of differentiation of responsibility between developed and developing countries which, under the Kyoto Protocol, were exempt from any emission reduction commitments and virtually from reporting on their emissions but which benefited from the Clean Development Mechanisms (CDM) credited to the developed countries that financed them did not necessarily, as in China, Korea or India, lead to a reduction in emissions, quite the contrary.

Moreover, the imposition of emission taxes, which are sometimes difficult to objectivise and unevenly applied or enforced, does not by its very nature constitute an incentive to identify and declare them, quite the contrary ...

Given the obvious difficulties in such a context to define, implement and adopt a reliable system of evaluation, management and taxation of these GHG emissions, in particular CO2 emissions from the use of carbonaceous energies, fossil or not (oil, coal, gas, peat, bitumen, industrial biomass for heating (mainly wood and pellets)), it is clear that the discussions seem to focus more on the means of treating hypertension when it is a heart attack that is threatening.

The risk of failure is therefore not only due to the possible political unwillingness of certain stakeholders (States, economic and industrial sectors, etc.), but also due to the nature of the processes proposed to control these emissions, which are difficult to measure and therefore to control.

Plan A" adopted at the end of the Paris Agreement

With this in mind, Plan A adopted so far consists of considering a carbon tax and, to this end, creating a market and a price for it. But this plan, despite its initial relevance, is facing an increasing number of obstacles that are difficult to overcome both individually and, above all, as a whole, and some of which have already been proven to be significant: the impossibility of quantifying and apportioning the innumerable multiplicity of their sources; the impossibility of regulating and controlling them in a sufficiently uniform manner to constitute a system that is operationally and equitably manageable. This is all the more so because in the absence of a 'global market', both politically and economically, the opportunities for circumvention and diversion will also be innumerable.

The four major obstacles to achieving the objectives of the Paris Agreement

The first major obstacle is that, generally speaking, significant costs are not integrated into the market prices of products, including fuels, fossil or otherwise, or into those of activities related to their use: those of their environmental impacts, in particular climatic impacts, which are known as their "externalities". However, if the final selling price of all fossil products does not include these "externalities", this is tantamount to legitimizing a system of sales at a loss, which should be considered unacceptable, particularly from a liberal economic point of view.

Losses, not for the companies, but for the States, which have to bear the cost of their impacts through indebtedness or increased taxes and social charges, which they are so bitterly reproached for moreover (10) ... And the product offers that attempt to include these externalities, in particular climatic externalities, in the current system are then necessarily more expensive than current market prices and therefore suffer from a situation of unfair competition preventing their development beyond a few "niche" markets.

The second major hurdle lies in defining the cost of fossil fuel "emissions permits", a cost that would determine a price in a carbon market. In theory, two major emission quota systems should make it possible to include the very many small diffuse sources of emissions, but also to promote the transition to uses or activities with a reduced or even zero climate impact, and thus create incentive conditions. A bit like a young household renting a "permit to live", a dwelling before investing more sustainably in its acquisition.

In this context, given the relative but obvious failure of this system, reforms are proposed, such as the establishment of a floor price for carbon at the European level.

This is already an option that is a little far from an illusory "market price", illusory because of the subsidies to fossil fuel extraction industries, the arbitrary allocation of emission "allowances" and the multiple pressures from political as well as industrial lobbies.

The quotas, for example, are allocated in a relatively arbitrary way, which is difficult to generalize globally and to all activities (e.g. heating of buildings responsible for nearly half of the emissions, tax-exempt aviation fuel, etc.), especially in a situation of economic crisis.

However, the market for CO2 allowances has still favoured systems of "cap and trade" covering in 2016 10% of emissions, even if the rules applying to these markets are incompatible and they cannot therefore be interconnected.

And as Emilie Alberola, head of the Carbon and Energy Market research unit at CDC Climat, points out, economic players are not sufficiently encouraged to make the long-term investments (30 to 50 years) required to reduce CO2 and other greenhouse gas (GHG) emissions, which means that a real "decarbonisation" of energy is still blocked for decades to come. A carbon emissions market does not therefore in itself constitute a coherent, operational and reliable system, but above all, it is fundamentally not an incentive to move towards a drastic reduction in their scale, while providing the financial means necessary for a real energy transition.

A third major obstacle is the need to obtain from States the funds necessary for the energy transition and promised in the framework of COP 21/22. One objective is to raise 100 billion on the horizon.

Emerging countries are called upon to provide financial means on a voluntary basis, while many are without resources, many others (over)indebted and others even more than reluctant to finance the system up to the stakes, and unfortunately very often promises only bind those who believe them. Another obstacle is the wide disparity in emissions (from less than 1 tonne to several tens of tonnes per capita), but it appears that a levy proportional to carbon consumption would in essence favour the countries that are the least "carbon consuming".

While many countries are nevertheless committed to contributing to this financing, many developing countries have made their contribution conditional on the availability of financial support from developed countries. The level of funding proposed is therefore far from meeting expectations and, above all, needs, and an international discussion on sharing a global carbon budget or a global carbon price has very little chance of succeeding in a world of sovereign states with a de facto veto.

The fourth major obstacle is the governance of energy transition plans. Whatever the plan, the establishment of revised principles of governance and ethics in the modalities of their application, monitoring and control, in particular financial control, is indispensable!

The world and public opinion need a major paradigm shift in the way in which national or international institutions, created or existing, are constituted, managed and controlled at all levels of public money management. This is evidenced by the many scandals in regional, national or international organizations, whether governmental or non-governmental. This implies the constitution of a draft Convention redefining the rules of operation of these institutions, a project whose importance and scope are hardly less than those that led to the Paris Agreement. It would be the prerequisite for the establishment of an independent but rigorously controllable international institution which would be genuinely capable of effectively managing the collection of the capital that excise duties will constitute, their allocation, distribution and use in the energy transition.

All this being said, the difficulty, which is certainly not the least in envisaging a Plan B to consolidate or even save the operational phase of the Paris Agreement in order to achieve its objectives in due course, is for everyone to be able to accept the very idea of taking into consideration this evolution of the Copernican paradigm, and to challenge well-established patterns in the brains, organisations and policies put in place.

But this paradigm shift may one day be what will appear in the face of urgency as the only option to avoid the inevitable ...

The proposal for an alternative "Plan B": taxing extractions rather than carbon emissions

In order to break the deadlock or to avoid rushing into it any further, it is therefore legitimate if not urgent to envisage a real paradigm shift. This, through a more global and integrative approach to the issues at stake, would generate a dynamic that is intrinsically more incentive than coercive in the implementation of a plan that is truly likely to meet the ambitious objectives of reducing carbon and other greenhouse gas emissions. Results that are necessary both in terms of scope and time.

In line with this approach, the proposal developed here consists of replacing the principle of taxes on carbon and other GHG emissions with a process with two complementary and articulated components:

a) On the one hand, a levy of an Excise Duty (11) Carbon Extraction (AEC) and the primary production of other greenhouse gases (GHG), from fossil carbon resources or other sources, synthetic or not: in particular agro-forestry and forestry.

This excise duty would be levied at the level of extractive entities (companies, States) by an international institution set up for this purpose.

The levying of Excise Duty on the basis of the quantities extracted, which can be generalised at the level of the signatory countries of the Paris Agreement, would therefore be intrinsic and relatively easy to objectivise, as the number of sources of extraction/production of resources that emit GHGs is infinitely lower and can be objectivised than the number of emissions resulting from their use.

In cases where this withholding tax is not effective, this duty would then be levied, on the carbon, products or services imported concerned, at the borders of the Associated Countries to the Global Agreement (PAAM) in the same way as a tax, such as VAT in Europe, which is levied on imports.

This would be defined through the generalisation of systems for calculating their "carbon externality" (raw materials and product manufacture, mainly transport), a calculation based on life cycle analysis methods that are now operational and will be discussed later. This would prevent non-signatory States from evading these constraints and would also constitute a means of economic pressure on their own activities by limiting their trade and export capacities.

Moreover, its proceeds would avoid the need for States, already often (highly) indebted, to commit themselves to directly mobilising the hypothetical financial resources indispensable to energy transition plans.

(b) On the other hand, a mechanism for redistributing excise duties in the form of incentive subsidies where these can be factually justified by concrete and verifiable actions by a reduction or absence of carbon or GHG emissions extracted or produced in particular in industry, housing, transport or agriculture.

Such as, for example, cogeneration of energy with renewable sources, production of polymers and other very long-life and/or non-emitting products, reduction of energy consumption by buildings and means of transport, or sustainable fixation or storage or reuse of carbon and other relevant GHGs.

This excise duty would have the advantage of being insensitive to variations in the emission allowances allocated or prices on markets that are inevitably speculative, as in the case of trading in CO2 emission permits. The generalisation and control of the levying of this excise duty on the extraction/production of GHGs and its payment would be guaranteed by a mechanism for tracing sources, particularly on imports, as is the practice for certain food chains.

On this point, this component is similar to the redistribution of subsidies and taxes provided for in the implementation of Plan A but, in this case, the identification of carbon emissions would have less the coercive character of leading to "punitive" taxation but, on the contrary, would have an intrinsic incentive character by offering, through appropriate controls, the means to carry out emission reduction actions and thus create a real dynamic in the operational implementation of a real energy transition.

How to implement "Plan B" for Excise/Counter-Excise

1/ By Levying Excise Duty on Carbon Extraction (AEC)

An excise duty set at USD 10/barrel (USD 25/t) on the 30 giga-barrels of oil extracted per year would not constitute, with a barrel price varying between USD 30 and USD 110, an insurmountable additional economic cost for users and consumers. This is far below the USD 50-100 carbon price suggested by the Think 20.

This would already generate from a single barrel of oil no less than 300 billion USD (!) which would then be available to finance excise duty refunds and energy transition projects as already decided at the Copenhagen Summit ... If we add to this the financial contributions from excise duties levied on coal, peat, conventional natural gas or shale, industrial biomass (wood and "pellets"), the proceeds from excise duties could approach one billion euros!

For countries - extractors or users of fossil carbon - that refuse to join the system, the implementation of "carbon" adjustment mechanisms at the borders for countries are, as W. Nordhaus' analysis shows, "the only way to ensure that the system will be effective is for countries to set up "carbon" adjustment mechanisms at the borders. (12), The challenge of assessing the content of the "carbon" externality of products or services is complicated to conceive. However, these data would still be more easily objectifiable than most diffuse emissions, and some tools are already operational in this area. (13).

2/ Through the implementation of a "carbon tax and market". But what are the limits?

A French economic analysis (14) considers climate change as an externality, which should be internalised by GHG emitters and which implies the implementation of a carbon price, through a tax or a market. Jean Tirole, winner of the Nobel Prize in Economics, recommends the levying of a "carbon tax" to be combined with a system of "Green Funds" linked to the emission permit market, a system in which a multilateral organization would allocate or auction tradable permits to participating countries.

Under this system, non-signatory states would be penalised by means of excise duties levied at the borders and managed by the WTO, the ECB or a specific institution set up for this purpose. This system would lead to the evolutionary setting of a carbon price "corridor". However, countries joining the system would only commit themselves on a voluntary basis to monitor the initiatives taken to set it up.

Christian de Pertuis also took up the idea(15) stressing that it would not distort competition but that its application would require companies to keep accurate accounts of the carbon flows associated with their activities, which is not beyond the scope of methodological instruments such as life-cycle analyses (LCA), making this operation generalizable.

In this context, its proposal to set up a bonus-malus mechanism whose agreement, including developing countries, would first cover the rules for redistributing the tax on the tonne of CO2 emitted before fixing the amount, could apply to the system based on the excise duty levied on carbon extraction. The advantage of the bonus-malus system is, according to Ch. de Perthuis, that it can be built on the basis of a rule of equality, or even equity in terms of per capita climate impact.

Other economists, such as Weitzmann (2015) (16,) also suggested that it would be easier and more effective to agree on a universal carbon tax. A Commission comprising thirteen economists from nine developed and developing countries co-chaired by Joseph Stiglitz and Nicholas Stern, and including the United States, the United Kingdom, the United Kingdom and the United States. (17) concluded, on the occasion of the Think2018 summit at the end of May 2017, that, in order to effectively achieve the international community's climate objectives while encouraging growth, it is imperative that countries set a price on carbon, with the aim of reaching between 40 and 80 dollars per tonne of CO2 in 2020 and between 50 and 100 dollars in 2030. But this option remains inherently difficult to control and can generate, like "tax havens", competitive imbalances that will inevitably benefit markets and companies.

However, the establishment of a hypothetical "carbon market" remains uncertain and the proposed measures, such as the carbon tax, are unfortunately more a plaster on a wooden leg than a global and operational strategy commensurate with the stakes and their urgency.

No existing international institution currently has the legitimacy to impose a tax on national governments or to monitor its proper implementation in all countries of the world. Such monitoring would be relatively complex, since it would be necessary to verify that the tax is properly implemented and that it is not offset by other tax adjustments on energy products. Such a transfer of fiscal sovereignty from all countries does not seem realistic, especially if it were to apply to taxation of inherently "local" emissions.

It is here that the not insignificant advantage of the principle of an excise duty or carbon tax on extraction is that a system of control and "sanctions" would, here too, be less complex than if it were to apply to non-compliance with carbon emission limits.

3/ By integrating carbon externalities in the price of products and services not subject to excise duty on extraction

Integrating the cost of climate and environmental, but also social "externalities" of carbon into the prices of products and services would be an important complementary incentive to ensure energy transitions and would be the means to cover products and services that have not been subject upstream to excise duty.

This integration would take place without necessarily increasing burdens on producers, users and consumers as long as they adopt solutions that selectively reduce their externalities, climatic and other. Such an option is particularly in line with the proposal for a carbon added tax (CAT) proposed by Laurent and Cacheux. (19) to control GHG emissions from their imports and the cost of climate externalities of imported products (20).

These climate externalities, positive or negative, would be calculated using existing tools, such as Life Cycle Analysis (LCA) or other tools under development or already developed, known as "monetization" of these externalities, notably by the 2019 Foundation. (21). In particular, they would have the advantage of reducing the situations of unfair competition highlighted above by mentioning the first major obstacle for players who have integrated measures to reduce carbon emissions.

In Europe, this could be part of a more general circular VAT, which would integrate all the environmental and social externalities, direct or indirect, of an activity or product, such as those defined in the framework of the Millennium Sustainable Development Goals. (22). A first experiment of such an approach has recently begun in France with the participation of ADEME ('Agence de l'environnement et de la maîtrise de l'énergie). (23).

4/ By financing energy transitions through the redistribution of excise duty in the form of incentive subsidies or "counter-excise duties".

The implementation of the allocation process or incentives for energy efficiency gains financed by the excise duty levied upstream, or "Counter-excise", could be implemented through the implementation of flexible incentive allocations through the presentation by the beneficiaries of validated certificates attesting to the Carbon Externalities Integration Rate (CERI) of an activity or a direct or indirect emissive use of fossil fuel or GHGs. These certificates would make it possible to differentiate between products, services and activities generating fewer or no GHG emissions by allocating a premium to the emissions differential or the energy efficiency gain obtained.

These mechanisms would, of course, require a structure to determine how allocations are made according to a grid of explicit and verifiable criteria.

In Copenhagen, a Green Climate Fund was created under the aegis of the Climate Convention, whose governance method required lengthy negotiations. The CPLC (Carbon Pricing Leadership Coalition) (24) which brings together national, regional and local governments, as well as businesses and NGOs, and which advocates carbon pricing could be interested in the principle of universal excise duty.

A World Fossil Carbon Bank with appropriate governance bodies, more reliable in their oversight than most current institutions, would probably be a more appropriate solution. This could include a governance or supervisory board in the form of a regularly renewed jury of members drawn by lot, including representatives of civil society according to a similarly appropriate procedure. The structure in charge of defining the criteria for allocation could be drawn from certain IPCC panels and other institutions competent in the field of energy technologies, also with appropriate governance bodies.

The advantages of Plan B - Excise/Counter-Excise

A first advantage of the Excise Duty/Counter-Excise Duty combination is that it is incentive in nature: can we imagine a potentially more operational process? Barak Obama had also envisaged (albeit too late in his second term ...) such a tax on the barrel in the US to finance the energy transition. (25), a tax that obviously did not excite economists...

The first objections in principle to this approach are, on the one hand, that producer countries would, by definition, be opposed to such "taxation at source" and, on the other hand, that it would constitute a form of "pollution permit" to which some are opposed in principle. The answer to this is that when a country or region such as the EU, or even the world community as a whole, imports products. He or she does not ask the country of origin for permission to impose taxation on them: is China being asked for permission to impose VAT on its imported products?

With respect to "permits to pollute", to judge this, the whole process must be seen in the context of the results of the transitional mechanisms made possible by the allocation of excise duty proceeds in the form of "permits to clean up", possibly combined with quantified emission limit targets.

Rather than social and environmental, or even constitutional, compromises, this is undoubtedly what should form the basis of pacts such as the TAFTA or, more urgently, the AACC, which has already been concluded with Canada and will very soon be put to the vote in the European Parliament.

This "Plan B", by granting these "permits to clean up" would resolve three of the key stumbling blocks encountered by negotiators in the current "Plan A" paradigm:

1. the near impossibility of generalised measurement of broadcasts, given their diversity and multiplicity;

2. the failure to take into account the climate footprint related to indirect emissions outside the territory linked to the import/export of finished products not subject to the constraints of the Paris Agreement;

3.- The Green Energy Transition Fund should no longer be fed directly by the "States", i.e. the managers of the "Common Goods", a burden that is difficult to bear because of the levels of public indebtedness. Wouldn't it be fairer if a very significant part of the efforts were to be assumed by the economic actors who have directly benefited from the "sales at a loss" of these energy sources over the last two centuries?

The major obstacle already highlighted, which is not specific to the challenges of managing energy transitions and defining and implementing truly reliable and operational governance systems, remains to be overcome. All institutions, national and international, governmental and non-governmental, and the entire economic and financial system are also at a crossroads at this level, as evidenced by the "businesses", almost as innumerable as the sources of carbon emissions ...

The really major obstacle?

A refusal of lucidity feeding a mental inertia in the face of paradigm shifts ...

All this being said, such a proposal is undoubtedly difficult to reconcile in the immediate future with "resistance to change". (26) This is the "common denominator" that characterizes both the political and economic stakeholders of our so-called advanced societies. And even that of the scientists and citizens that we are.

This real mental inertia combined with a certain refusal of lucidity ("let's be optimistic"), with which the actors involved or implicated will not fail to be confronted, imposes on everyone the will to question their traditional points of reference.

This requires, in particular, mobilising and supporting public opinion when they are finally convinced of the urgency of implementing targets and means of reducing carbon emissions that are truly commensurate with the issues at stake.

Even if this is still hypothetical, this should not prevent, in the spirit of Romain Rolland: "to associate the pessimism of intelligence with the optimism of the will! »

Jacques de Gerlache and Roman Ferrari

(2) Ce document est aussi disponible en français

(3) Dr Sc Pharm, (eco)toxicologist, active member of the Club of Rome - EU Chapter, manager of GreenFacts - www.greenfacts.org

(4) President of the 2019 Foundation http://www.fondation-2019.fr

(7) USD 550 to 5,600 billion per year depending on the definition and method of calculation:

(8) C. de Perthuis & R. Trotignon. The climate: at what cost? The climate negotiations. Odile Jacob, 2015.

(9) C. Gollier & J. Tirole "Negociating effective institutions against climate change. "Economics ofEnergy and Environmental Policy 4 (2015).

(10 ) A typical example of the cost of these externalities is the external cost in France of treating (purifying) water of the excess nitrogen resulting from the use of fertilisers: 50% of quantities spread are not captured by plants. This cost reaches 100,000 €/t while its selling price varies between 500 € and 1,000 € per tonne ...

(11) What differentiates an Excise Duty from a tax is that it is a monetary levy calculated on the basis of objective and stable parameters (e.g. tonne of product) and not on a market value (e.g. price per barrel).

(12) Nordhaus W. (2015), "Climate Clubs: Overcoming Free-Riding in International Climate Policy", American Economic Review,

(13) For example : https://www.iso.org/obp/ui/#iso:std:iso:14040:en

(14) Economic analysis of the Paris Agreement - French Ministry of the Economy and Finance TREASURY - No. 187 - December 2016 http://www.tresor.economie.gouv.fr/tresor-eco

(16) Weitzmann M.L. (2015), Internalizing the Climate Externality: Can a Uniform Price Commitment Help?

(17) Formed at COP22 by the Coalition for Leadership on Carbon Pricing (CPLC).

(18) supported by the World Bank Group and the French government - via the Ministry of Ecological and Solidarity Transition and the Environment and Energy Management Agency.

(20) In France, for example, since 1990, the carbon footprint has increased by 15% while direct emissions have declined by 7%!

(21) See the Foundation's project 2019 content/uploads/2013/03/MISSION-TVA CIRCULARV20110216.pdf

(25) http://www.rff.org/blog/2016/environmental-merits-obama-s-oil-tax-proposal Taxing Oil: Good Climate Policy? http://www.rff.org/blog/2016/taxing-oil-good-climate-policy

Why so many economists back Obama's idea of a tax on oil https://www.washingtonpost.com/news/energyenvironment/wp/2016/02/08/why-many-economists-support-obamas-idea-of-a-tax-onoil/?

(26) Who does not persist in seeing, 500 years after Copernicus, the sun "rising" in the sky when we know that it is the movement of the horizon that reveals it? https://www.youtube.com/watch?v=v_F20If0-P0

[…] Pour en savoir plus… LIRE ET RELIRE l’article de Up’Magazine […]