The international community's ambition to combat global warming has a cost: between $50,000 and $90,000 billion over the next 15 years, according to estimates by economist Adair Turner for the low range and economists from the Commission on Economy and Climate "New Climate Economy" for the high range. By comparison, the annual global GDP is almost $80 trillion. The report of the "New Climate Economy" points out that $2 trillion in the North and $4 trillion in the South are needed each year to fund green infrastructure to bring the world close to carbon neutrality in time to reach the target of limiting warming to +2°C above pre-industrial levels by the end of the century. Is the private sector able to meet these costs?

The right pace for the energy transition

According to the World Bank, private debt, excluding financial institutions, now stands at $110 trillion, or 138 % of world GDP. Total public debt, on the other hand, is close to 60 billion dollars, or about 75 % of GDP.

However, as Marc Carney, the Governor of the Bank of England, pointed out in a famous speech in 2015, a too rapid transition to a low-carbon economy risks jeopardising financial stability. And too slow a transition, on the contrary, runs the risk of soon exceeding irreversible ecological thresholds (particularly in terms of soil erosion).

How fast should the private and public sectors move forward?

In a recent articlepublished in the journal Ecological Economics and devoted to the GEMS (General Monetary and Multisectoral Macrodynamics for the Ecological Shift), we shed new light on the nature of the compromises needed to comply with the Paris Agreement.

To do this, the GEMMES model combines financial dynamics, climate change projections and the United Nations' median demographic scenario (9 billion people in 2050) on a global scale. As with any forward-looking modelling tool, the figures we put forward are only indicative, due to the significant uncertainty that remains regarding the interaction between the environment and the economy.

There is a risk of economic collapse

In the "laissez-faire" scenario - the one where no additional public policy is implemented to encourage the productive sector to accelerate its investments in green infrastructure - global warming is observed to be close to +4°C in 2100. The +2°C threshold is crossed as early as 2050 due to the lack of effort to reduce emissions.

The damage then induced by global warming accelerates the depreciation of capital and slows down economic activity.

According to the consulting firm Carbon 4, 2017 already holds a record The costs of weather-related disasters have never been higher. They have reached more than $400 billion, for those that could be estimated. Insurers have borne a significant part of them, with 135 billion dollars covered, according to the German reinsurer Munich Re.

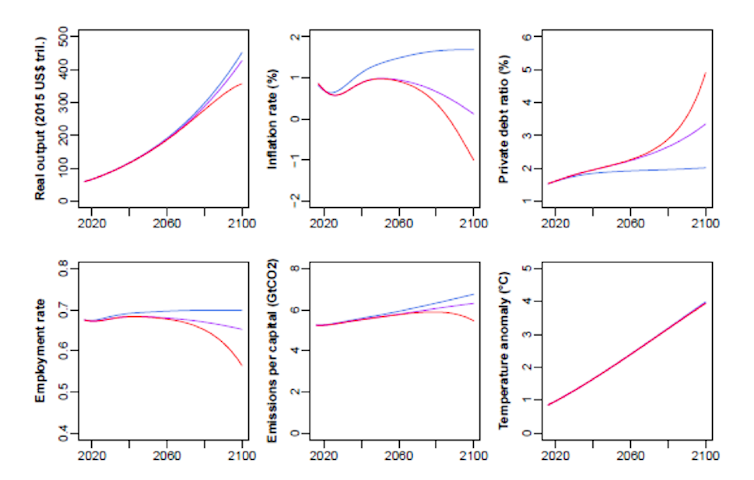

Our simulations using the GEMMES model show that the reduction in economic activity related to climate and investment in mitigation technologies results in lower growth, less employment and increased private debt.

Given the margins of uncertainty surrounding the quantification of the economic impact of warming, we tested several hypotheses regarding the magnitude of damage to be expected.

If we adopt the most pessimistic hypotheses - generally considered the most realistic by climatologists - we can even observe, in the absence of voluntary public intervention, scenarios of economic collapse similar to those that emerged, for reasons unrelated to global warming, from the Meadows team's prospective analysis in his report to the Club of Rome in 1972.

Macroeconomic trajectories without proactive public policies according to the different scenarios considered by the GEMMES model: low damage (blue line), low damage impacting capital (purple line) and high damage impacting capital (red line). GEMS/AFD, Author provided

Carbon pricing will not be able to do everything

How can such a disaster scenario be averted?

Carbon pricing could give the productive sector the price signal needed to invest in decarbonizing the economy. One thing seems almost certain: unless there is additional industrial deployment of carbon sequestration, carbon pricing, at whatever level, will not keep the planet below the 2°C threshold.

Without negative emissions, i.e. without the industrial deployment of carbon capture and storage techniques, it is probably already too late to comply with the Paris Agreement, a widely held opinion in the climate community. Indeed, achieving this objective would require completing the energy transition around 2020 with a carbon price of around $540. If the transition were to be entirely financed by the private sector, it would then trigger an economic recession of the order of -5 % of world GDP - a situation that is difficult to sustain politically - accompanied by a significant increase in the level of private debt by nearly +130 GDP points compared to 2016.

Conversely, a slower short-term carbon price trajectory, in the order of $100 in 2040 to $450 in the 2050s, would certainly protect the world economy from too great a forced decline during the transition, but would cause global warming at the end of the century of around +3°C, with partly incalculable consequences.

Moreover, it would not be free of a still high level of private debt, advocating the implementation of complementary proactive public policies, such as subsidies for green investment, as advocated by the report of the Stern-Stiglitz Commission on the price of carbon.

Choosing between GDP growth and the fight against global warming

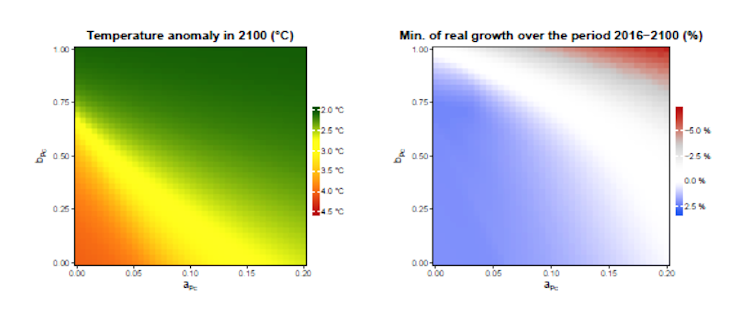

This temporary trade-off between GDP growth and the fight against global warming reappears in all the scenarios considered. It can be observed, for example, in the figure below established under a median hypothesis concerning the severity of climate damage: to each pair of parameters (a,b) corresponds a carbon price trajectory.

GEMS/AFD, Author provided

Parameters a and b should be chosen so as to remain as close as possible to +2 °C, i.e. in the area closest to dark green, the top right corner of the left cartridge. Alas, this is also the grey-red area of the right cartridge, which indicates a constrained decline in the world economy during the energy transition.

The dilemma stated by Mark Carney is illustrated here by the need to implement a carbon trajectory that keeps the economy in the white zone of the left cartridge, which corresponds to a temperature increase of between +2°C and +2.5°C.

No matter how fast we move towards carbon neutrality, these graphs illustrate a trade-off between growth and climate change during the energy transition.

It should be noted, however, that productivity gains, such as new jobs in the renewable energy and circular economy sectors (recycling, repair, rental), are to be expected from this transformation, and could qualify this trade-off.

Countering deflation, supporting "green" public spending

In all the cases studied, the global economy is more resilient to global warming if it has less private debt, less unemployment and a higher share of wages in GDP.

This last result suggests that the debate on the distribution of value between capital and labour is not independent of the climate issue. To our knowledge, the mechanism underlying such an outcome is new. Indeed, climate disruption seems to be leading the world economy towards deflation, according to a well-known macroeconomic pattern: stagnation leads to a fall in prices and real GDP, which in turn leads to an increase in underemployment and debt, and then to an erosion of the share of wages in national income. A redistribution policy in favour of labour incomes appears, in our analysis, to be a natural response to this deflationary spiral and thus to the impact of global warming.

The final lesson from our simulations is that if it is accompanied by public support for part of the green investment expenditure, carbon pricing in the spirit of the Stern-Stiglitz ReportWith a price corridor centred around $44 per tonne in 2020, $140 in 2030 and $300 in 2040, it would make it possible to remain close to +2.5°C at the end of the century while avoiding the deflationary slope.

Without additional public spending, on the other hand, such a macro-climate trajectory already seems out of reach: carbon pricing certainly provides the incentive for the private sector to finance the green infrastructure we need, but it does not alleviate the burden of the corresponding private debt. Of course, even partial assumption of this burden by the State will be at the expense of public finances. But, as we have seen, their situation is currently less deteriorated than that of the private sector.

Moreover, in the event of a deflationary threat, public debt is not necessarily the problem but can be part of the solution. By combating both the macro-financial impact of global warming and its anthropogenic causes, the public contribution to the financing of the transition would thus kill two birds with one stone.

Gaël GiraudChief Economist, AFD (French Development Agency) and Florent Mc Isaac, , AFD (French Development Agency)

The original text of this article was published on The Conversation.

Anything to add? Say it as a comment.![]()