Release of the November issue of the Annales des Mines - Industrial Realities Series: The Economics of Gold. Coordinated by Françoise ROURE and Serge CATOIRE.

Ahe Réalités Industrielles series publishes quarterly thematic dossiers on subjects of importance for industrial and economic development. Led by a specialist in the sector under the aegis of the series' Editorial Committee, each dossier presents a wide range of complementary points of view, calling on authors from both teaching and research, business, administration, and the world of politics and associations.

Introduction by Françoise ROURE, Conseil général de l'économie (General Council for the Economy) :

"Since time immemorial, gold has been symbolically charged with an immeasurable value between, on the one hand, that which is attributed to it at the fiduciary level and, on the other hand, that which results from the use of this material for its physico-chemical properties and its biocompatibility, for its technical potential at the macro, micro and nanometric scales, in art and civilizations. Present in industrial and energy processes, as well as in health applications, gold is produced at more than 3,000 tonnes per year, with an estimated 180,000 tonnes of gold extracted and transformed. An interest in gold - this "barbaric relic", according to John Maynard Keynes (1) - and more particularly in the gold economy in the 21st century, could seem obsolete since the implementation of the Bretton Woods agreements on the international financial system after the Second World War ended on 15 August 1971, with the end of the convertibility of the dollar - the so-called reserve currency of the 20th century - into gold. Yet the alienating quest for gold, synonymous with eternity, power and might, is still alive in the 21st century, with a mixture of alchemical, magical, festive, ritual and demonstrative attractions, an imaginative meaning in the arts and jewellery, but also, more prosaically, a beautiful and good historical nerve of the war and its anticipation through the precautionary savings behaviour of households. On the monetary and financial side, the value of gold rises with the anticipation of shocks such as hyperinflation, negative interest rates or an unfavourable evolution of the tax system. Alan Greenspan, former President of the US Federal Reserve, considers gold to be the world's primary currency, because it is the only one that does not require any signature in return (2). However, not all gold transactions today are necessarily linked to the ownership of physical gold. This is notably the case on the market of gold Exchange Trade Funds (ETFs) - or gold ETF funds - which, since 2004 (the date of their creation), have aimed to facilitate access to the gold market for investors wishing to diversify their assets without taking delivery of physical gold. As a result, the gold that these markets are backed by cannot be considered as a real safe haven in the event of a generalised crisis. On the gold-material side, China, with 450 tonnes per year, has become the leading gold producer since 2017, far ahead of Australia, Russia, the United States, South Africa and Mexico. The recycling of electronic products is struggling to make a significant contribution to the supply of gold in a market characterised by growing demand from central banks, which have been increasing the share of their gold reserves since the 2008 financial crisis. For the European Union, 27 % of the European Central Bank (ECB) reserves were in gold in 2016. Private demand for physical gold remains strong, more for precautionary rather than speculative savings purposes, whether or not it is jewellery. According to the World Gold Council, this represents around 50 % of the use of physical gold, with an estimated value of $3.6 trillion for 90,000 tonnes. The official public reserves of central banks are, by comparison, of the order of 1.2 trillion, with coins and ingots of a comparable amount. ETF gold funds represent a market of USD 86 billion for a stock of around 2,430 tonnes in May 2018, with a dominant private player holding a stock of around 1,500 tonnes. Finally, an estimate of unaccounted physical gold gives it a market share of around 15 %, with a quantity tending towards 30,000 tonnes, which highlights the illegal exploitation and trafficking of gold, encouraged by the anonymity of transactions and the practice of laundering. Parallel circuits thrive in the absence of a well-defined international standard of traceability that would make it possible to identify the origin of the gold. This situation facilitates all abuses, in terms of human and environmental exploitation, tax evasion and the financing of illegal or even criminal activities. Unaccounted production is said to originate in certain sub-Saharan African countries, such as Côte d'Ivoire, Mali and Burkina Faso, or the Democratic Republic of the Congo with its North Kivu province. Production and marketing channels also exist in countries of the Great Lakes region, such as Rwanda and Uganda. The traceability of gold has thus become a major issue, which is being addressed in France by the Bureau de recherches géologiques et minières (BRGM), a public institution, by developing, in partnership with the WWF (3), a scientific and technical approach based on its knowledge and know-how as a national geological service.

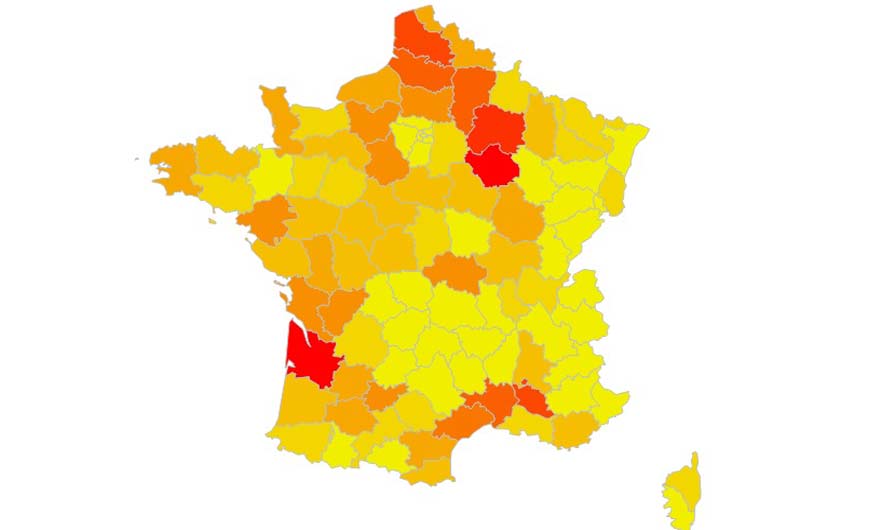

The values attributed to gold fluctuate with changes in the price of bullion. The reference price for gold, traditionally set by auction in London, is now strongly influenced by the Shanghai Gold Exchange (SGE), which sets the SHAU, the unit of quotation expressed in yuan per gram, the trading unit being the kilogram. China, the world's leading user of gold, is deploying a systematic long-term strategy of substituting the yuan for the dollar in international transactions involving raw materials, critical metals and rare earths, oil and gold, and this will become more sustained from 2017 onwards. Thus Jiao Jinpu, the chairman of the EMS, announced the preparation of "a fund for the development of the gold market of the new Silk Road to promote our gold contracts in yuan and to encourage players to develop more scenarios and derivatives (4)". Attitudes towards the coins and bullion market vary considerably depending on taxation. This is the case, for example, between France and Germany: for example, the German gold bullion market represents 120 tonnes per year, compared with only 9 in France. This can be explained by the fact that at a comparable savings rate (17 % in Germany, 14 % in France), unlike France, Germany does not tax sales of gold in the form of coins, bullion or ingots, unless a speculative capital gain is made during the year. This issue of the Annales des Mines documents, firstly, exploration and exploitation techniques for gold mines, highlighting the physical and financial constraints to which they are subject, but also the scientific and technical advances that make it possible to progress towards a more responsible mine, particularly in terms of human safety. Finding and exploiting the mine is indeed the first step towards the use of gold. Without this progress towards a more responsible mine, any implementation of such a social project is a source of difficulties that inevitably give rise to public debate. Post-mining management must now be formalised at the project preparation stage, with an explicit environmental requirement applying to the entire French territory, failing which it will be rejected by the local residents and populations concerned. The industry and markets for physical gold are presented in the second part of this issue, with an analysis of the structure of the physical gold markets based on Minéralinfo, BRGM's monitoring tool, and a few examples of applications, particularly in terms of innovative industrial applications of catalysis, or art and culture. The third and last part illustrates monetary and financial gold through household savings behaviour, the role of central banks in market regulation and the importance of gold in the economy. This diversity of testimonials will convince the reader that gold represents, beyond its symbolic weight and the refuge value that we lend it, a whole real economy, from mining exploration to its many industrial and commercial uses. »

(1) Quote: "In truth, the gold standard is already a barbarous relic", A Tract on Monetary Reform, John Maynard KEYNES, London, Mac Millan & Co., 1924, p. 172.

(2 ) Gold Investor, February 2017, p. 12.

(3) WWF: World Wide Fund for Nature.

(4) Shanghai Daily of 16 October 2017.